Note you do not get a a Personal Allowance on taxable income over 125000 Key points of Malaysias income tax for individuals include. Tax Rate of Company.

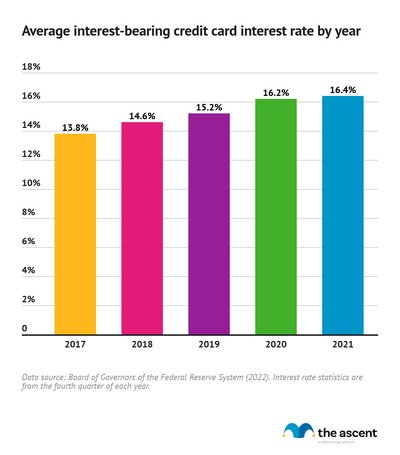

Credit Card Debt Statistics For 2022 The Ascent

Last reviewed - 13 June 2022.

. Malaysia Personal Income Tax Rate. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. Paid-up capital up to RM25 million or less.

Chargeable Income RM Calculations RM Rate Tax RM 0 5000. Types Of Income. Other corporate tax rates include the following.

Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. Here are the income tax rates for personal income tax in Malaysia for YA 2019. Personal Income tax is payable on the.

The standard corporate income tax rate in Malaysia is 24. What is the Corporate Tax Rate in Malaysia. Rate Business trade or profession Employment Dividends Rents.

Malaysia Residents Income Tax Tables in 2019. Malaysia located in Southeast Asia is separated by the South China Sea into two non-contiguous regions. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Calculations RM Rate TaxRM A. These companies are taxed at a rate of 24. Resident company with a paid-up capital of RM 25.

Corporate - Taxes on corporate income. Companies with income not exceeding RM 2500000 per year are. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Tax Rates for Individual. Rate On the first RM600000 chargeable income. The existing tax exemption for interest earned on wholesale money market funds will cease with effect from 1 January 2019.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. On the first 5000. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Income from RM500001. Last reviewed - 13 June 2022.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is. Corporate tax highlights. Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax.

There will be a two. Malaysia personal allowances and tax thresholds or Malaysia business tax. Malaysia Income Tax Rate 26 Corporate Tax Rate 25 Sales Tax Service Rate 5 - 10 Personal Income Tax.

6 rows Petroleum income tax is imposed at the rate of 38 on income from petroleum. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. For both resident and non-resident companies corporate income tax CIT is imposed on income.

Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24. If the paid-up capital is RM 25 million or less for a resident.

Following table will give you an idea about company tax computation in Malaysia. Malaysia Residents Income Tax Tables in 2019. The deadline for filing income tax in.

In The Household Expenditure Survey Report 2019 Released Today Dosm Noted That The Increase In Average Or Mean Monthly Household Spendi Household Johor Months

%20(1).png)

Updated 2022 Despite Turbulent 2020 Home Builder Profit Margins Rose Coconstruct

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Malaysia Economic Performance First Quarter 2019home Statistics By Themes National Accounts Malaysia Economic Performance Malaysia Forced Labor Economy

Dubai Package 4 Days 3 Nights Trip To Charming City Of Uae And Enjoy With Fun Tours

Honda Civic Rs Turbo Is Pakistan S Fastest Sedan Expert Review Honda Civic Civic Honda Civic Turbo

Germany Long Term Interest Rate 1993 2022 Ceic Data

Spin996 Online Casino Congratulation Dear Customer Deposit Myr 100 00 Withdraw Myr 700 00 Slot Game Toda Online Casino Games Today Slots Games

Most Profitable Companies In The World Statista

Doing Business In The United States Federal Tax Issues Pwc

Diwali Special Offer Sri Lanka Tour Package From Fernweh Vacations Rate 600 Per Person 6 Nights 7 Days Pack Travel Poster Design Travel Travel Posters

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

Irs Tax Return Audit Rates Plummet

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

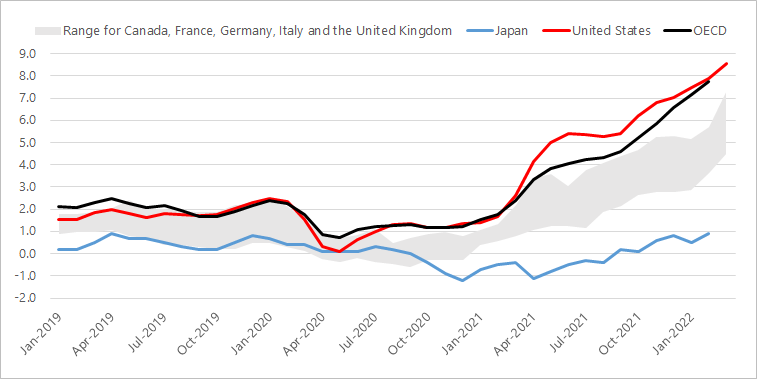

Statistical Insights Why Is Inflation So High Now In The Largest Oecd Economies A Statistical Analysis Oecd

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More